Could Reddit Stock Become the Next Snap?

Equity Market ·TL;DR

Researching Reddit also expands my knowledge of Reddit language organically 😀. TLDR is such a nice word for summarizing my investment thesis:

Reddit’s plateaued user growth combined with weak advertisement monetization do not make the stock a strong buy even at $45

Plateaued User Growth

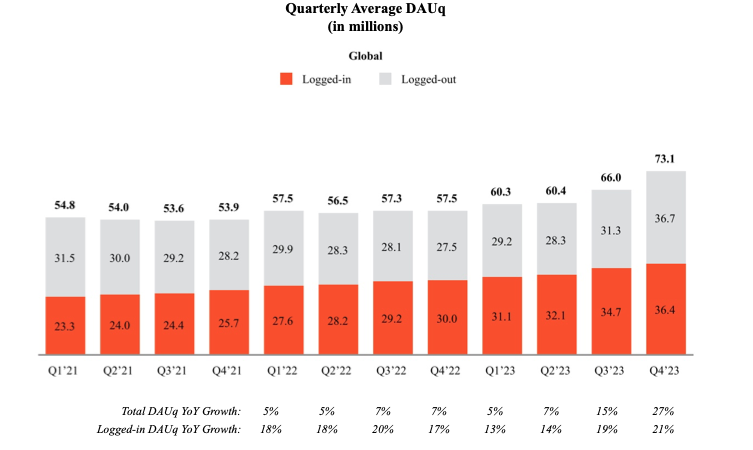

According to Reddit’s prospectus, the average daily active user (DAU) had an average annual growth rate of 9% for the past 3 years. Given that Reddit has more than a decade of operating history, this growth rate also indicates that Reddit is in the maturity phase, a stage characterized by stabilized growth rate.

In comparison, Meta and Snapchat, which are also mature companies in the same age as Reddit, have an average of DAU growth rate of 6.4% and 10% respectively. These numbers suggest that Reddit’s growth rate is no better than its peers.

Even though Reddit has posted significant improvements in total DAUq YoY growth for the past 2 quarters in 2023 (15% and 27% respectively), I think Reddit’s self-identified growth factors (“product enhancements and third-party search engine and algorithm changes”) require further examinations.

Weak Advertisement Monetization

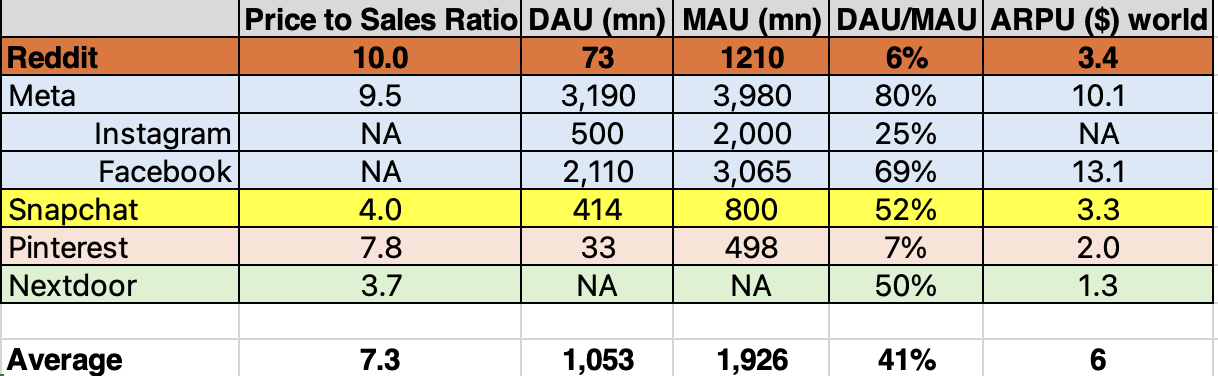

In the table below, I have summarized key metrics that compare Reddit’s user base, user engagement, and ARPU to its peers.

To account for seasonality, I averaged Reddit’s quarterly ARPU for the past 3 years. In the years 2021, 2022, and 2023, Reddit’s ARPU was $2.24, $2.91, $3.07, which shows a CAGR of 17%. Despite the rapid growth, Reddit’s ARPU is still in the same range as its underperforming peers—Snapchat, Pinterest, and Nextdoor. In contrast, the Meta family has a global ARPU of $10.1, showcasing an industry-leading monetization ability.

Besides ARPU, another concerning factor is Reddit’s user engagement, which is measured by daily active user over monthly active user (DAU/MAU). The stickier a product is, the higher percentage of monthly users visits the product daily, resulting in a higher DAU/MAU ratio.

Before making the engagement comparison, we also need to note a key feature that differentiates Reddit from its peers. While other apps require logins, Reddit has about 50% of logged-out users, who browse and engage with the app without registered accounts.

In addition to the difficulty and ambiguity of tracking logged-out users, logged-out users also tend to have lower engagement. This feature might explain why Reddit has the lowest DAU/MAU ratio among its peers.

In summary, Reddit having one of the lowest ARPU and the least engaged user base has a difficult road ahead to prove its monetization ability and justify its current valuation.

Valuation Multiple

I chose price-to-sales ratio to compare Reddit with its peers because some of my chosen companies do not have positive earnings.

With Reddit trading at $49/share, it has the highest price-to-sales ratio of 9.95x. If Reddit only has advertising as its main revenue (which is true for its current state), this valuation screams the stock being overvalued.

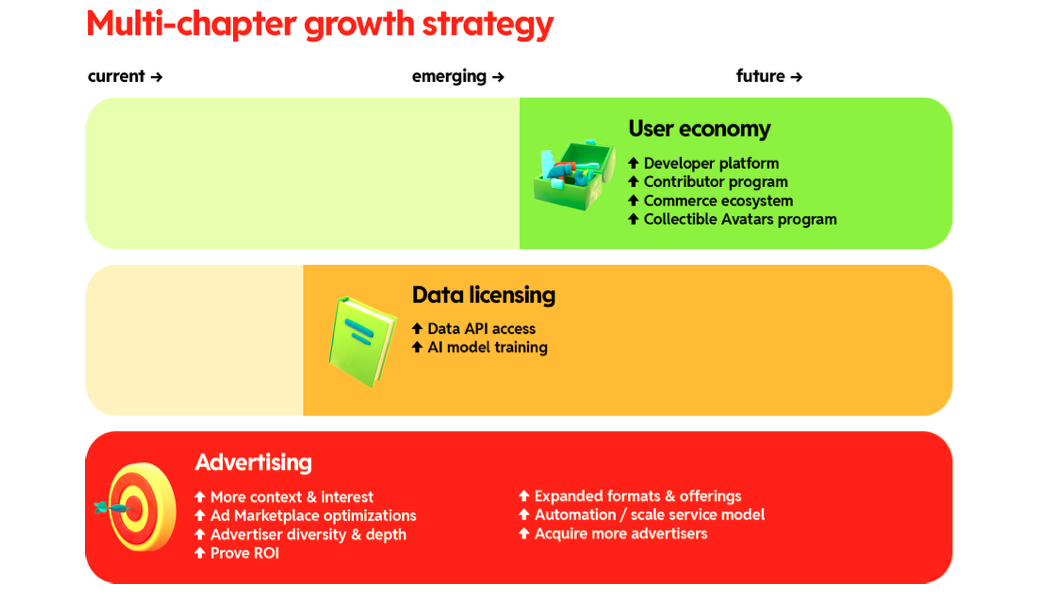

After reading its monetization strategies, I tried to reconcile this multiple by taking into account of values from its Data Licensing and User economy businesses. Data Licensing generates revenue from granting “Data API access” and “AI model training.” For this business, Reddit has already struck an AI licensing deal with google worth $60 million per year.

The best case for Reddit is to have this $60 million deal added to its top line in perpetuity. To calculate its present value using the geometric series formula, I assumed no growth rate in the contract value given more competitions in data licensing business and a discount rate of 5%.

PV = a / (1- r) = $60 million / (1 - 1/1.05) = $1.26 billion

Dividing by the total number of ordinary shares, it gives me a present value of $9.1/share. This means that under my assumptions, data licensing business will bring an added value of $9.1/share.

However, I do believe this number overvalues the data licensing business because of the future uncertainty of AI-training related regulations that may affect how companies could utilize user data. To account for this risk, I would give $9.1/share a further discount.

To value Reddit’s User economy business, I think it’s fair to assume that we could use the current multiple of Meta (9.5x) because it already has an established marketplace. This is already a best case scenario for Reddit because Meta has much better monetization ability and other revenue sources which Reddit does not have.

My Three Valuation Cases

Time to distll my analysis into numbers!

- In the best case scenario, Reddit has Meta’s P/S multiple (9.5x) and an additional $9.1/share for its API licensing business. This brings the stock price to $64/share.

- In the base case scenario, Reddit has industry average ps multiple and (7x) and a discounted licensing value add (let’s say $5/share). This brings the stock price to $45/share.

- In the worst case scenario, Reddit has the average multiple of its underperforming peers (5.1x) and discounted licensing value add (let’s say $5/share). This brings the stock price to $34/share.

There are currently no comments on this article, be the first to add one below

Add a Comment

Please share your comments below! Note: comments will be moderated