Wingstop and the Fast Casual Rally

Equity Market ·Fast casual stocks have seen significant growth in the past year. But how much of their growth is coming from improving business operations rather than from multiple inflations in the market?

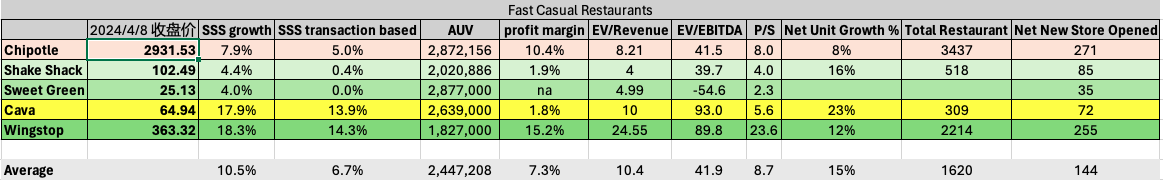

While I sought answers to this question, I found that Wingstop (WING) has valuation multiples that significantly exceed those of its fast casual peers. What could be the secret sauces (pun intended) justifying WING’s 150x PE and 90x EV/EBITDA?

I plan to focus my analysis on WING’s operation, franchisee expansion and macro factors.

1) Does WING have superior operations?

From its financials, WING does have starring growth in same-store-sales (18% yoy), a key like-to-like metric in evaluating the operation result of restaurants. Adjusting for about 4% menu price increase impact, its SSS growth has 14% attributable to each store’s improved ability to sell.

Despite what the number said, I am concerned with WING store’s ratings and average unit volume (AUV) that put WING far behind its peers.

WING operates in locations where its direct competitors such as Popeyes, Chick Fil-a, KFC, McDonald also have presence. However, a typical WING store on average has a Google map rating around 3 and reviews under a thousand whereas its competitors usually have higher ratings and number of reviews. By these metrics, WING store does not seem to serve its customers better than its peers. [To further validate this point, more work for scrapping and analyzing regional rating and review data is needed.]

WING also has the lowest AUV of $1.8 million compared to its fast casual peers. If this number could mean either space for revenue expansion or limited ability to generate revenue, the prior ratings likely suggest the latter.

2) Has WING achieved significant expansion in franchised stores?

Wing has 12% of net unit growth, which suggests that they are in the stable expansion phase. Since WING has about 98% franchised stores, its revenue primarily consists of initial development fee, sales royalties (6%) and 5.3% of advertising budget from franchisees. The top line growth story of WING will continue as long as new franchisee are added every year and existing franchisees having reasonable AUVs.

But that’s for the short term. In the long term, the sustainability of WING’s growth story depends on the relative attractiveness of its franchisees’ profitability and lifespan.

3) Macro Factors

-

A trend towards healthy and clean diet puts downward pressure on WING. Its potential and existing customer base is likely to shift towards Chipotle, Sweetgreen, Cava and other chains that position to serve healthier food.

-

WING currently benefits from a historical low wholesale price on chicken wings, a trend which may reverse in the future.

-

Fast casual restaurants are perceived as defensive stocks that may perform well during market downturns. As investors have more uncertainties towards the overall economy, there may be more long interests in fast casual restaurants for hedging purposes.

4) (A Not-So-Refined) Valuation of WING

What’s a reasonable valuation multiple for a franchise? McDonald being the industry leading example only has a max of 23x EV/EBITDA multiple for the past 10 years. Chipotle being a company-owned restaurant chain currently has 41x EV/EBITDA.

If adjust McDonald’s multiple by WING’s rapid growth, maybe 30x is a reasonable number, which brings WING’s stock price to $112/share.

If we adjust CMG’s multiple by WING’s larger operation margin from its franchise model, maybe 50x is a reasonable number, which brings WING’s stock price to $202/share.

In either case, WING’s current stock price ($355/share) significantly exceeds what I came up above.

There are currently no comments on this article, be the first to add one below

Add a Comment

Please share your comments below! Note: comments will be moderated